If you are looking to restructure your business then BBS Law is able to advise you on all aspects of inter-group reorganisations and demergers.

Contact UsCorporate News

Corporate Case Studies

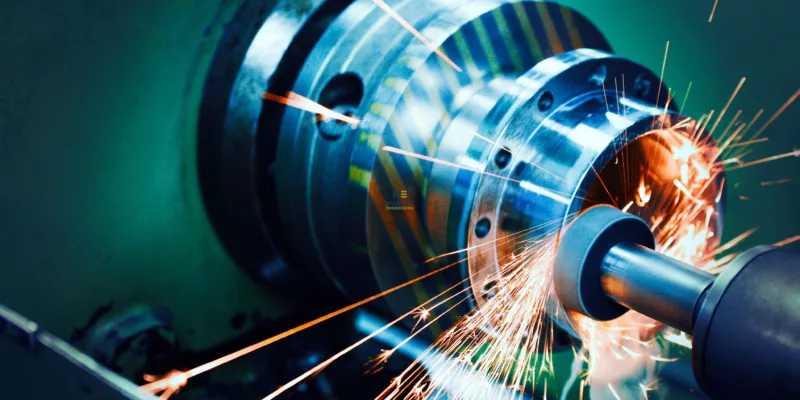

BBS Law advises Mantec Engineering on sale to Allied Global Engineering

BBS Law are delighted to have acted for Peter Ford, managing director of Mantec Engineering, in the sale of the company to Macclesfield engineering group, Allied Global Engineering. Openshaw-based Mantec Engineering is a provider of precision tuned and milled components…